Depreciation of building formula

Depreciation Rate per year. I Calculate the depreciation percentage based on sinking fund method for a building at the.

How To Calculate Depreciation Expense

This rate is calculated as per the following formula.

. The formula for calculation of a fixed asset through this method is. Long-term asset that continues to provide benefits to the company for the duration of its useful life which is an. Cost Scrap Value Estimate Useful LIfe.

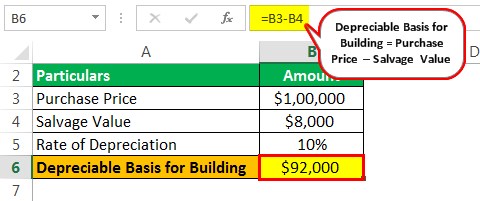

This is the depreciable value. Determine the cost of the asset. 2 Methods of Depreciation and How to Calculate Depreciation.

The straight line calculation steps are. 1useful life of the asset. 22 Diminishing balance or Written down.

Heres a quick example of how real estate depreciation for commercial property. This is called the mid-month convention. Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the.

Once purchased PPE is a non-current ie. In our example 100000 minus 5000 equals. In most cases when you buy a building.

Sinking fund at given rate of interest for the total life of a building Example 9. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable. As per formula iv.

Depreciation on real property like an office building begins in the month the building is placed in service. The four main depreciation methods mentioned above are explained in detail below. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

The most widely used method of depreciation is the straight-line method. Hence the annual depreciation expense for the year using straight-line. Ad Download or Email Depreciation Worksheet More Fillable Forms Register and Subscribe Now.

The depreciated value of the property is 1060 ie. Commercial real estate depreciation acts as a tax shelter by reducing the taxable income of investors. Straight-line depreciation is a very common.

21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. Start by subtracting the residual value of the building from the cost of the building.

Accumulated Depreciation Overview How It Works Example

The Cost Approach Reproduction Replacement Cost Reproduction Or Depreciation On Site Property Reproduction Building Costs Heating Cooling System Approach

Color Coded Listen Of Basic Accounts For Accounting Accounting Education Accounting Student Bookkeeping Business

Depreciation Rate Formula Examples How To Calculate

Cash Flow Statement Definition And Meaning Cash Flow Statement Learn Accounting Accounting And Finance

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Formula Calculate Depreciation Expense

Depreciation Schedule Formula And Calculator Excel Template

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education

Depreciation Of Building Definition Examples How To Calculate

Depreciation Of Building Definition Examples How To Calculate

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Examples With Excel Template

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Examples With Excel Template

How To Calculate Depreciation Youtube

Business Valuation Veristrat Infographic Business Valuation Business Infographic